|

|

Enhance Knowledge

| EnhKnowTM

,

LLC

Technology Brokerage & Royalty Servicing |

|

|

|

|

|

|

Business

Communications |

|

|

In Perspective: Bankruptcy,

Reorganization and Viability Analysis |

|

Published: June 25, 2020 |

Original Media: This publication |

|

Updated: None

|

Admittedly, the bankruptcy protection filing of every company is unique

to the company. Yet there are discernable similarities between many of

them. The financial profile of a bankruptcy company generally falls in

one of three forms as depicted in Figs 1 – 3, and depends on the stage

of evolution of the company along the trajectory of the Product Life

Cycle curve as defined by the primary product of its Core Business, as is profiled through Fig.1 Commodity

Bankruptcy, Fig 2 Stunted-Growth Bankruptcy, and Fig 3 Distressed

Bankruptcy: which are also delineated presently in eliciting their

differences, while noting that the green profiles represent cash inflow

while the red profile represents cash outflow

The

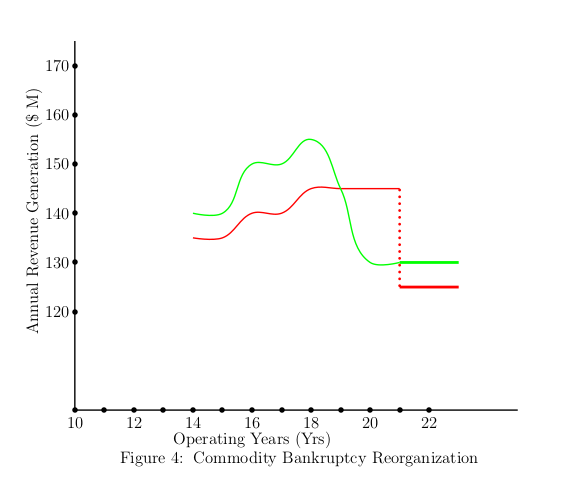

Commodity Bankruptcy Company represents the collection of companies that

have evolved into the Commodity Stage of the Product Life Cycle at the

time of filing

for bankruptcy protection, and is as depicted in Fig 1, and is

|

|

|

|

characterized by near aligned evolution of the cash in- and out-

flows profile prior to the filing of the

bankruptcy protection. Such bankruptcy types are described by the

bankruptcy filings of General Motors of 2009 and of McDermott

International of 2019. As would be further noticed, the drop of the cash

inflow (the green line) to a level below the cash outflow (red line) happens over a span of time,

the expanse of which depends on the operations but generally is

consequent on interruptions of operations

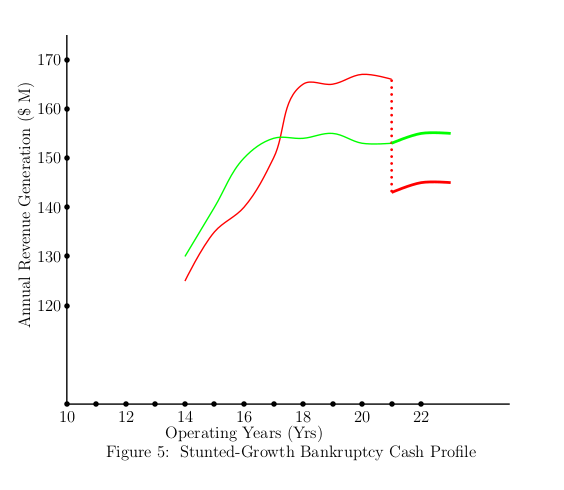

The Stunted-Growth Bankruptcy Company represents the collection of companies that

are still evolving through the Growth Stage of the Product Life Cycle at

the time of filing

for bankruptcy protection, and is as depicted in Fig 2, and is

characterized by near aligned upward evolution of the

|

|

|

|

cash in- and out- flows profile, as characteristic of Growth Stage, prior to the filing of the

bankruptcy protection. As would be further noticed, in this conditions

of bankruptcy filing the cash

inflow does not fall below the cash outflow but rather gets stunted and

flattens out while the cash outflow increases past the inflow before

stabilizing and effecting sustained negative differential cash flow over a span of time,

the expanse of which depends on the operations but generally happens

with interruptions of Market Participation as forced by the Business

Model

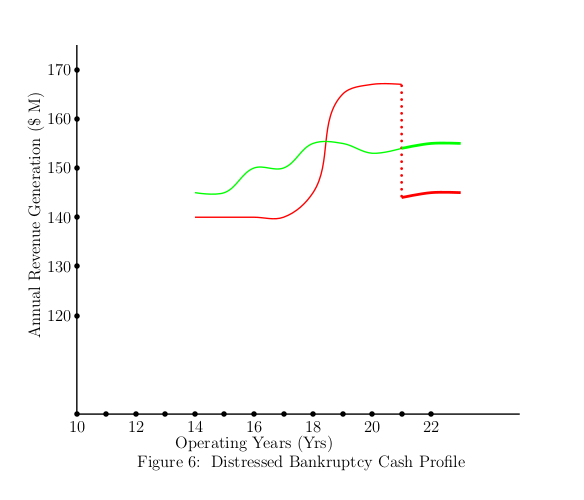

The Distressed Bankruptcy Company represents the collection of companies that

are evolving through any of the product growth stages of the Product

Life Cycle curve at the time of filing for bankruptcy protection, and is as

depicted in Fig 3, and is characterized by gradually increasing cash

inflow and gentle |

|

|

|

correspondingly upward gradient of the cash outflows profile both

indicative of steady growth, but then suffers a near Step-Jump increase

of cash outflow-demand forcing the filing of the bankruptcy protection. As would

be further noticed, there occurred neither drop nor flattening of the

cash inflow profile as with the previous cases but rather a an almost

Step Jump of

the cash outflow that is indicative of a default in any of debt repayment

constructs creating Distress operations conditions.

The relationship of the assets to debt at the moment of filing

of the

bankruptcy effectively defines the conditions of bankruptcy usually

documented as the Disclosure on which the

Reorganization Plan must be based. The reorganization is essentially defined

by the dotted lines that drop vertically from the cash outflow to a

lower level than the cash inflow.

Effectively, irrespective of the form of the Disclosure, the

reorganization always requires the downward folding of the debt stream

to a level lower than the cash inflow stream as shown in Fig 4 – 6 such that

the corporation enjoys net positive cash flow again. |

|

|

|

|

As such, bankruptcy reorganization necessarily focuses on the

financial design of the Disclosure to develop yet again a state of self support of

the company. Very commonly most assets-secured debts are

preferentially converted to stocks in the new company so that the

corporation continues to own the assets with which to operate the

business after emergence from the Court-protection. Other similar debt

conversions are made so that the corporation owns all crucial

operational assets required to sustain its operations.

While the presentation defines the essential approach, the

implementation, of course, is case-specific, and must be addressed

singular to each bankruptcy filing. All the same, in essence, each of the

debt components is examined for the purposes of modification in a manner

that is acceptable to the creditors. However, while the restructuring

is, often times, readily constructed and packaged as Reorganization Plan, the

issue of interest is whether or not the proposed changes will have only

all the intended consequences, given the well known invariable

consequential outcome of

unintended consequences that attend intended consequences. The

considerations then become the predictive assessment of all the possible unintended consequences of the

Reorganization Plan adopted to force down the cash outflow stream below

the cash inflow stream into creating a positive differential between the

cash in- and out flows, and enable positive

cash-flow.

For one thing, the Reorganization Plan, often, changes the markets of

participation of the post-emergence corporation ever so much that the

initial post-emergence market allocation will be different. So then

there is the need to determine if the new market allocation and sales

model will provide viable basis of operating the company. Another

critical consideration is the alignment between the organization

structure and the production operations relative to the gross margins;

this analysis is crucial because the cost structure and pricing policy

adopted may not always be coincident with those prevailed upon the

business by the sum total of business planning for operating the

business, going forward, as reflected by the operations viability

analysis datasets as shown in the

datasets

graphical plots that must be constructed in capture of the business

operations of the corporation The computational analysis of the myriad factors, and more so the

Production Analytics, to the end of assessing the operational cost

structure, are some of the mission-critical objects of the Reorganization

Plan Viability analysis that is required to be

performed as necessary component of the legal resolution of bankruptcy

filings, and that is performed in course of the Bankruptcy

Reorganization Viability Analytics service. |

|

|

|

|

|

|

|

|